Does Cit Bank have Zelle? This question is crucial for anyone considering Cit Bank for their financial needs, especially those who rely on the convenience and speed of peer-to-peer payment apps. Understanding Cit Bank’s payment options, including whether or not they offer Zelle integration, is key to making an informed decision about your banking relationship. This exploration delves into the specifics of Cit Bank’s payment methods, comparing them to other popular options and highlighting the security measures in place to protect your financial information.

We’ll examine customer experiences with Cit Bank’s payment systems, exploring both positive and negative feedback to paint a comprehensive picture. Furthermore, we’ll explore alternatives to Zelle should Cit Bank not offer it, considering factors like speed, fees, and security. By the end, you’ll have a clear understanding of how Cit Bank handles payments and whether it aligns with your personal banking preferences.

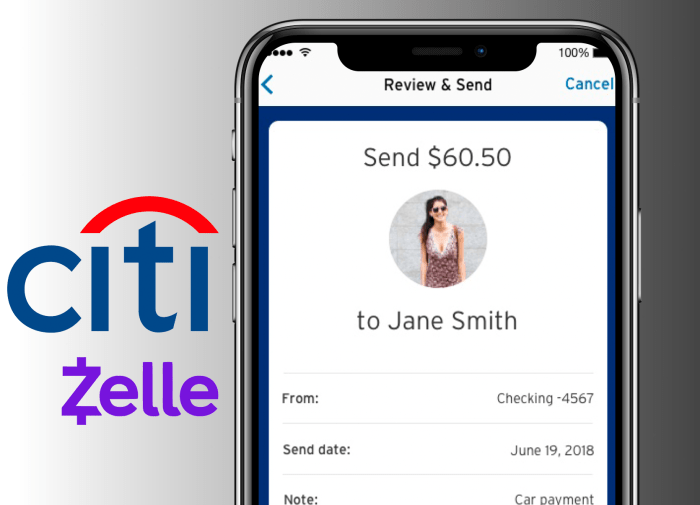

Cit Bank Payment Methods and Zelle Integration

Source: sharilyn.ca

This article provides a comprehensive overview of Cit Bank’s payment methods, including its integration with Zelle, alternative payment options, security measures, and customer support resources. We will explore the features, limitations, and user experiences associated with each method, offering a clear and informative guide for Cit Bank customers.

Cit Bank’s Payment Methods

Cit Bank offers a variety of payment methods to cater to diverse customer needs. Understanding the features, limitations, and security aspects of each option is crucial for making informed financial decisions. The following table summarizes the key characteristics of each payment method offered by Cit Bank.

| Payment Method | Description | Fees | Availability |

|---|---|---|---|

| Online Bill Pay | Pay bills directly from your Cit Bank account to various vendors. | Typically free, but may vary depending on the vendor. | Available to all online banking customers. |

| Debit Card | A plastic card linked to your checking account for in-person and online purchases. | Usually no fees for standard transactions, but ATM fees may apply. | Available to all checking account holders. |

| Credit Card | A card that allows you to borrow money for purchases, with interest charges if not paid in full. | Interest charges, annual fees (may apply), and potential late payment fees. | Subject to credit approval. |

| Zelle | A fast and secure peer-to-peer payment service integrated with Cit Bank. | Generally free for users. | Available to eligible online banking customers. |

| ACH Transfers | Electronic transfers between bank accounts. | Fees may apply depending on the transaction type and recipient bank. | Available to all online banking customers. |

| Wire Transfers | Faster, but more expensive, method of transferring funds between banks. | Fees typically apply, varying based on the amount and destination. | Available to all online banking customers. |

Zelle Integration with Other Banks

Source: thestockdork.com

Zelle’s integration with other major banks allows for seamless peer-to-peer transfers. The process involves linking your Cit Bank account to the Zelle network, enabling you to send and receive money from individuals using other participating banks’ Zelle services. While the user experience is generally consistent across platforms, minor variations in interface design and functionality might exist. Security concerns, while minimal with Zelle, include the potential for scams and unauthorized access if users fall victim to phishing attempts or share their information with malicious actors.

Always verify the recipient’s identity before sending money through Zelle, regardless of the banking platform.

Customer Experiences with Cit Bank’s Payment Systems

Customer feedback on Cit Bank’s payment systems reveals a generally positive experience, with Zelle being particularly well-received for its speed and convenience. However, some users have reported occasional issues with online bill pay and ACH transfers, primarily related to processing delays. A smaller percentage of users have expressed concerns regarding customer support response times for resolving payment-related problems.

Positive Experiences: Many customers praise the ease of use of Zelle and the speed of transactions. The mobile app is also frequently cited as user-friendly and intuitive.

Negative Experiences: Some customers report occasional delays in processing payments, particularly with ACH transfers and online bill pay. Customer support response times have also been a source of occasional frustration for some users.

Infographic (Textual Description): A bar graph would show customer satisfaction levels. Zelle would have the highest bar, followed by debit card and credit card usage. Online bill pay and ACH transfers would have shorter bars reflecting slightly lower satisfaction due to reported processing delays.

While CIT Bank doesn’t offer Zelle directly, understanding your options for sending money is important. If you need a faster transfer method than a standard ACH, you might consider a wire transfer, but be aware of the associated costs; you can find details on the cit bank wire transfer fee to plan accordingly. Therefore, exploring alternatives to Zelle with CIT Bank requires careful consideration of fees and speed of transfer.

Alternatives to Zelle for Cit Bank Customers

Several alternatives to Zelle exist for Cit Bank customers, each with its own strengths and weaknesses. Choosing the best option depends on individual needs and priorities regarding speed, fees, and security.

- PayPal: A widely used online payment platform. Pros: Wide acceptance, buyer protection. Cons: Fees can be higher than Zelle, slower transfer times.

- Venmo: A popular peer-to-peer payment app. Pros: Social features, user-friendly interface. Cons: Security concerns if not used cautiously, potential for scams.

- Cash App: Another popular peer-to-peer payment app. Pros: Ease of use, direct deposit capabilities. Cons: Fees may apply, potential for fraud.

- Wire Transfers: A faster, but more expensive, method of transferring funds. Pros: Fast transfer speeds. Cons: High fees, limited use cases for personal transactions.

Security Measures for Online Payments at Cit Bank

Cit Bank employs robust security protocols to safeguard customer financial information. These include encryption of data transmitted between the customer’s device and the bank’s servers, fraud detection systems, and regular security audits. Two-factor authentication adds an extra layer of security by requiring a second verification method, such as a one-time code sent to the customer’s phone, in addition to a password.

Customers should also practice good online security habits, such as using strong passwords, avoiding suspicious links, and regularly monitoring their accounts for unauthorized activity.

Cit Bank’s Customer Support Regarding Payment Issues, Does cit bank have zelle

Cit Bank offers various channels for contacting customer support, including phone, email, and online chat. To report payment-related issues or disputes, customers should clearly document the transaction details, including dates, amounts, and recipient information. Cit Bank’s customer support team will investigate the issue and work to resolve it efficiently.

- Gather all relevant transaction details.

- Contact Cit Bank customer support through your preferred channel.

- Clearly explain the issue to the representative.

- Provide all necessary documentation.

- Follow up as needed to ensure the issue is resolved.

Closing Summary: Does Cit Bank Have Zelle

Ultimately, choosing a bank that meets your payment needs is paramount. While the answer to “Does Cit Bank have Zelle?” may influence your decision, a broader understanding of their overall payment infrastructure and customer support is equally important. This comprehensive look at Cit Bank’s payment ecosystem empowers you to make the best choice for your financial well-being, considering both the convenience and security of your transactions.

Remember to always prioritize security when using online banking and payment methods, and don’t hesitate to contact customer support if you encounter any issues.